THANK YOU - YOUR FREE REPORT IS BELOW

9 Ways To Collect Extra Income

9 income secrets used by the rich… but available to anyone

CUSTOM JAVASCRIPT / HTML

It’s not stocks… Not bonds… And not real estate…

Yet, for a few lucky readers, this type of simple source of income could send you real, hold-in-your-hand paychecks for the rest of your life.

1. How To Collect "Instant Dividends" Of An Extra $1,000 (Or More) A Month

Investors tend to think there are only two ways to make

money with stocks… but I’ll show you a third way. It’s a strategy you can use to boost your income

from almost any stock, earning up to $1,000 more a month than you’d see otherwise.

Most people don’t know about this loophole, because at its heart is something many investors don’t understand—stock options.

Options tend to have a bad reputation. They can sound complicated, too, with myriad “strike prices” to consider

and “expiration dates” to keep track of. Then there are the scare stories

about how risky options can be . . . and how a frighteningly large number of stock options “expire worthless.” Who wants to invest in something that regularly loses all its value?

They sound complicated, and there are plenty of scare stories about how risky they can be. But the truth is that there’s nothing to fear if you use options correctly. In fact, I’ll tell you how to avoid the

mistakes most investors make. (Hint: It involves playing options the opposite way most investors do.)

So how do options work?

Stock options trade alongside stocks on the major exchanges. You can buy and sell them just like you do any stock. And like stocks, their price goes up and down in response to market conditions. The option’s price is called the premium.

The biggest difference between stock trading and options trading is what you’re trading.

Stock shares, of course, represent part ownership in a company.

When you buy a stock, you buy a part of the company. When you sell your stock, you give up that ownership.

Options are a little more complicated. When you buy a

stock option, you are actually buying a contract. That contract gives you rights to 100 shares of a given stock — either the right to sell the stock at a set price, or the right to buy the stock at a set price. That set price is called the option’s “strike price.” Each options contract is enforceable up to a specific day, known as the expiration date.

You can pay money for the right to buy the 100 shares of stock at a set price—the strike price—before the option expires. That’s called a call

option.

Or you can pay money for the right to sell 100 shares of stock at the strike price before the option expires.

That’s called a put option.

Instead of being the person who buys puts and calls. I want you to be the person who sells the contracts. The real secret to selling puts is to select stocks

that you would like to buy at a lower price.

So you should target steady, stable companies, or choose

options that expire sooner rather than later. A smaller

premium is better than a high premium that could be

taken away anytime.

Three Rules for Writing Puts for Income

1. Never write puts on stock you don’t want to own

2. Never write puts with a strike price above what you’d

be comfortable paying for the stock.

3. Never write a put just because you’ll receive a large

premium.

By writing puts and calls on carefully selected stocks, you

can create a never-ending income cycle.

Start by selling some puts on a stock you wouldn’t mind

owning. Set aside the premium income you receive. If the puts expire worthless, write some more puts. (And remember to have the cash on hand to buy the shares just in case.)

Most people spend their whole lives working to make someone else’s dream come true.

You should be working hard for yourself — to better YOUR life.

Click here to see all the ways you could start doing that today

2. How To "Juice" Up Your Favorite Blue Chip Stocks

Did you know there’s a way to boost your dividend payments

by 500%? I didn’t think so. Most stockbrokers don’t want you to know about it.

Why? Because this cheap, simple and safe way to drastically

increase your dividend payments doesn’t require a brokerage account. You get higher payouts and cut your broker out of the loop.

Best of all, all you need to do to get started is to fill out a

short form and make a small initial investment — as low as $50. That’s it. You won’t have to add another penny.

As The Wall Street Journal wrote:

"DRIPs are the best-kept secret on Wall Street,” says Vita Nelson,

editor of Moneypaper, a newsletter devoted to DRIPs.

Most people haven’t heard about them for one simple reason—companies can’t advertise their DRIPs. Why? Securities and Exchange Commission rules won’t let them say much about this fabulous way of saving and building wealth, except to existing shareholders.

Or as Tim McAleenan Jr. of The Conservative Income Investor put it, it’s:

The best-kept secret of the long-term dividend investor.

Historically, you had to directly contact the company in order to enroll

in their program, but today, many online brokers will help reinvest your dividends for little to no cost—you’ll just have to look at the fine print to make sure it is an option.

Sound too good to be true? It’s not.

More than 1,000 companies offer a way to invest with them

directly through dividend reinvestment plans (DRIPs). To participate, most companies with DRIPs require that you own just one share.

Once you’re a shareowner, every time a dividend is paid, it’s

automatically reinvested into more shares of the company’s stock. Those shares generate more dividends, which are again reinvested to buy even more shares. And the cycle continues.

Before you know it, you’re collecting five times more

dividends than you were when you bought the stock — without putting another penny into the investment. When dividend gains are repeatedly reinvested into additional shares of a company, the power of compounding takes over. With compounding, you earn returns on your returns from prior periods. While the rate of return may be the same or vary year to year, since you reinvest the dividends, your investment balance grows exponentially.

Do You Own Gold?

See that volume spike? Somebody just decided to buy a LOT of gold.

And I think I know why... it’s all about a meeting that’s scheduled for September 18.

If you own gold (even just a few ounces of it) you’ve got to see what’s happening.

The big announcement is just days away. Click here now.

A small number of shares can grow into a large number

over the long term, even without future purchases.

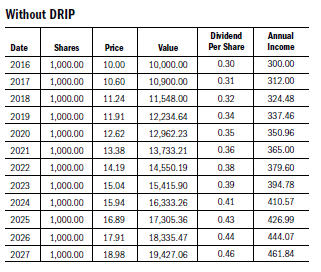

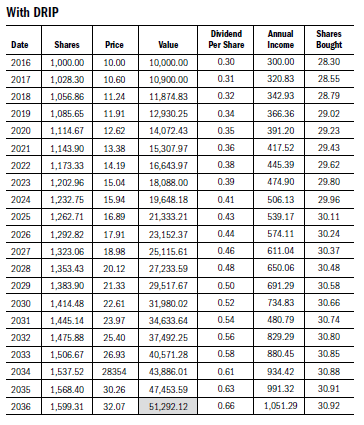

To show you how this dividend “juicing” works, let’s take a closer

look at an elite U.S. business that can boost your dividends by more than

250%: Annaly Capital Management (NYSE: NLY).

Here’s how a hypothetical $10,000 NLY investment would look after reinvesting dividends in a DRIP for 20 years. For calculation purposes,

we’re assuming annual dividend growth of 4% and an annual stock price increase of 6%:

As you can see, you start with 1,000 shares. But as the stock pays

dividends, you automatically buy more shares. By the end of 20 years,

you own nearly 1,600 shares, without putting in an additional cent of your own cash.

Additionally, all of those shares continue to pay dividends. You go

from collecting $300 a year to $1,051.29 as your position grows.

Notice what the compounding does to your total return. Again, assuming

a modest growth rate of 6%, your $10,000 initial investment is worth $51,292 in just 20 years—well over five times your money, producing gains 81.9% larger than a regular stock purchase!

This is, of course, is just a hypothetical example. Why don’t we take a look at a historical example that shows the value of this strategy?

Consider

your standard blue chip companies that have been around for decades, such as Exxon Mobil, McDonald’s and Proctor & Gamble. These companies had an average rate of return of about 10% for the past 20 years—pretty standard for a quality company. Not spectacular, but not outrageously good, either.

The dividend reinvestment strategy significantly increased the total return on the investment. By not reinvesting dividends, shareholders lost between $13,895 and $147,735 worth of value.

When you look at those numbers, there is no question about how valuable

dividend reinvesting can be for your portfolio. If you invested $10,000 in TJX in 1995, you would be sitting on $868,465, or a cool $1,016,200 if you had reinvested dividends, a difference of $147,735. It’s an astonishing figure.

In fact, this video presentation will show you 177 ways you can change your life starting today.

It’s never too late to get started. Some people made $1 million in 92 days and retired early! Watch the demonstration now...it could change your life.

Besides utilizing the power of compounding, DRIPs

provide a number of additional advantages…

1. When you purchase shares of a company through

a broker, you’re hit with a brokerage fee. Over time, these fees can take a huge bite out of your

returns. DRIPs allow you to reinvest dividends back into the company without paying a brokerage fee. This can make a huge difference in your long-term returns.

2. Once you’ve purchased at least one share of stock

and enrolled in a DRIP, you’ll be able to purchase partial shares of the company with your dividends. You won’t have to save cash to purchase full shares.

3. Because you’re investing in a DRIP periodically

— usually quarterly when dividends are paid — you’re able to buy more shares of stock when the stock price is low and fewer shares of stock when its stock price is high. This is known as dollar cost

averaging. This helps lower your overall purchase price of a stock, thereby boosting your returns.

4. While dividends are reported as capital gains, dividend reinvestment plans do not make any cash payouts. While stock prices may rise, no capital

gains tax need be paid until the stock is sold. The longer the shares are held, the lower the tax rate.

The lower your tax rate, the more gains you keep.

It’s not stocks… Not bonds… And not real estate…

Yet, for a few lucky readers, this type of simple source of income could send you real, hold-in-your-hand paychecks for the rest of your life.

3. How the Rich Beat

Taxes and Inflation

In the corporate tax world, one dreaded phrase reappears when you talk about dividends: “Double Taxation”.

All incorporated companies are taxed on the income they make. The shareholders are taxed again on any dividend distribution they receive from the company. So the same income is taxed twice. But, there is a way around it…

Master Limited Partnerships, or MLPs, are nearly identical to royalty income trusts. The only difference

between them is double taxation. Regular trusts must pay taxes on income before it is distributed to shareholders. Those shareholders also have to pay taxes on the already-taxed income when they receive it. MLPs, on the other hand, are limited partnerships. Therefore, they pay no taxes.

Only unitholders, as owners of MLPs are called, are responsible for paying taxes on the income they receive

from the partnership. MLPs are usually trusts comprised of natural resource, financial services, and real estate assets. Many own oil and gas wells, refineries, or pipelines. Others own hotels, restaurants and stores — much like REITs. Still others own certain assets like royalties in gold or copper mines. Some specialize in certain countries or regions, while others are more diversified. We’re sticking to North American energy pipeline partnerships. We’ll show you why in a moment…

One downside of MLPs is you shouldn’t invest in them through IRAs or other tax deferred accounts. Since

they already receive a tax benefit, many IRAs won’t include them. Those that do, could complicate the tax scheme.

Of all the types of MLPs available, energy partnerships are the most attractive. Most of these kinds of businesses

own pipelines, refineries, storage facilities and terminals. These kinds of operations, especially pipelines, are extremely stable cash-generating businesses.

More importantly, MLPs are so profitable that they are among the best dividend payers you can find. High

single-digit yields are commonplace when looking at MLPs.

Here are the top 3 MLP Oil & Gas Master Limited Partnerships:

- ENERGY TRANSFER PARTNERS (NYSE: ETP)

- MAGELLAN MIDSTREAM PARTNERS (NYSE: MMP)

- ENTERPRISE PRODUCTS PARTNERS (NYSE: EPD)

This book is exciting for lots of reasons – 177 to be exact.

On page 221, you’ll learn how to create an online course — and have a shot at earning $23,500 in 45 minutes.

On page 197, I’ll show you how to potentially make $2,000 a weekend, from anywhere in the world.

And on page 161, you’ll find 10 businesses you can start from home today! That is just some of the reasons!

You don’t have to settle for a job you hate.

4. Get Paid Like a Landlord for the Rest of Your Life

Most people spend their whole lives working to make someone else’s dream come true.

You should be working hard for yourself — to better YOUR life.

Click here to see all the ways you could start doing that today

5. The Secret "Real Estate" Investment With Guaranteed Returns

Do You Own Gold?

See that volume spike? Somebody just decided to buy a LOT of gold.

And I think I know why... it’s all about a meeting that’s scheduled for September 18.

If you own gold (even just a few ounces of it) you’ve got to see what’s happening.

The big announcement is just days away. Click here now.

It’s not stocks… Not bonds… And not real estate…

Yet, for a few lucky readers, this type of simple source of income could send you real, hold-in-your-hand paychecks for the rest of your life.

6. Get paid from every financial transaction in the world

Equinix Inc.’s (NYSE:EQIX)

data center and is a modern wonder of the financial world. It’s located a few miles from downtown Manhattan and processes every trade, order

and transaction on every major stock exchange.

Roughly 9.6 million messages are sent through its fiber-optic cables

every second, and trillions of dollars pass through its doors every day. But the NY4 is not just home to the NYSE and Nasdaq…Other major tenants include the Chicago Board Options Exchange, ICAP, IEX and Bloomberg.

To give you an idea of how valuable the NY4 is, in order to get inside access to the servers, you have to pass through five separate security checkpoints, including palm-print scanning, pin-number entry and constant video surveillance. The building has an ultrahigh-tech cooling system that maintains a stable temperature in order to keep the building running 99.9999% of the year. In case of a power failure, the NY4 has thousands of batteries to provide eight minutes of electricity while 18 backup generators the size of freight trains get warmed up.

NY4 is one of Equinix’s most valuable properties, but it’s not the only

property under their operation. In fact, Equinix is considered a REIT and has 145 data centers around the world. They have more than 8,000 customers, including tech giants such as Amazon, Verizon, Microsoft, Netflix, Facebook and LinkedIn.

Best of all, you can become a part owner of Equinix and claim a share of their lucrative dividend. Remember, as a REIT, Equinix must pay out 90% of their earnings by law. That means every time its tenants pay rent, you get cash in the form of a dividend. But it’s not just the dividend that is attracting investors.

Had you bought Equinix in February 2003, you would be looking at

12,033% gains on your investment. Those are returns money managers dream of. Year after year, Equinix continues to add properties to their list of assets and make the company more valuable for shareholders. It is no wonder Equinix is such a hot company. Their business model has made them extremely valuable, which is reflected in their stock price.

They currently have a $24 billion market cap and pay a 2% dividend. As a

REIT, whenever the NYSE or Nasdaq pays rent to Equinix, Equinix returns the payment to investors in the form of a dividend. As long as Equinix maintains their positive relationships with banks, stock exchanges and hedge funds, you can be sure to expect this income stream for years to come.

Remember, Equinix houses the world’s major stock exchanges and servers for the largest tech companies in the market. They take their business very seriously and have become one of the best REITs in the world.

Investors have made money hand over fist with Equinix, and I expect

their success to continue with the expected cash flows coming from their big-name clients. I recommend buying shares of Equinix and claiming rent from their tenants today.

This book is exciting for lots of reasons – 177 to be exact.

On page 221, you’ll learn how to create an online course — and have a shot at earning $23,500 in 45 minutes.

On page 197, I’ll show you how to potentially make $2,000 a weekend, from anywhere in the world.

And on page 161, you’ll find 10 businesses you can start from home today! That is just some of the reasons!

You don’t have to settle for a job you hate.

7. Invest In Real Estate Yourself

Most people spend their whole lives working to make someone else’s dream come true.

You should be working hard for yourself — to better YOUR life.

Click here to see all the ways you could start doing that today

8. How to boost your social security benefits by over $500 per month

Do You Own Gold?

See that volume spike? Somebody just decided to buy a LOT of gold.

And I think I know why... it’s all about a meeting that’s scheduled for September 18.

If you own gold (even just a few ounces of it) you’ve got to see what’s happening.

The big announcement is just days away. Click here now.

9. How to profit from the modern-day gold rush...and get paid for it

It’s not stocks… Not bonds… And not real estate…

Yet, for a few lucky readers, this type of simple source of income could send you real, hold-in-your-hand paychecks for the rest of your life.

BONUS: The Three Pillars of Income Investing

I can’t take full credit for the ideas I’m about to share with

you. Some of the credit belongs to Bill, the founder of a prominent hedge fund company that I used to work for. He started his business in 1985, and made money every single year. To my knowledge, his winning track record is intact. So that made him an excellent mentor.

My job was to create income for our high-net-worth clients

(each client had to have at least $1 million in assets) and to protect their capital against losses. To do that, I used what became known as the Three Pillars of Income Investing — a trio of criteria that helps pinpoint low-risk stocks with high dividends and excellent profit potential.

Here’s what you should look for in every income stock you buy:

1. Capital protection and preservation: We want stable

companies with lots of cash and little debt, meaning they can weather any crisis that may crop up.

2. Room for growth: We want to see a company with

growing earnings and revenue. At the very least, it needs a plan to boost its growth.

3. Sustainable dividend payments: We look for

companies that have steadily increased dividends, and make sure they’re rising for a reason. (Again,

a company could be paying out higher dividends to mask trouble.)

Once you’ve bought a good company, you can put the power of compounding to work. To do that, you simply use the dividends you receive to buy more shares of the stock. Some companies and brokers even let you do this automatically through a dividend reinvestment plan, also known as a DRIP. (See above for a DRIP primer.) Each

share you own adds to the dividends you receive.

There’s a ton of academic research showing how much

you could make reinvesting your dividends in this way. In 2007, Tweedy, Browne Company — an investment firm that’s been around since 1920 — published a concise rundown of various studies into dividend stocks. It proves, as they a put it, “the correlation of high dividend yields to attractive rates of return over long measurement periods.”

At some point, you may not want to use 100% of your dividend payouts to go towards buying more shares. That’s when you can extract that money to spend however you please.

If you follow the 4% rule, you can aim to extract 4% of your

money from your retirement account each year, which will leave enough money in your account to continue growing

If you want a 'done for you system' that can show you how how to earn $23,500 in 45 minutes, watch this video right now. You'll see it live on camera. This could double your “salary” overnight.

Download the key to a seven-figure pot pension in the 21st century: CLICK HERE

Every day you wait,others are growing richer from this strategy.

*This manual is for informational and entertainment purposes only. The author is not an investment adviser, financial adviser, or broker, and the material contained herein is not intended as investment advice. If you wish to obtain personalized investment advice, you should consult with a Certified Financial Planner (CFP). All statements made in this manual are based on the author's own opinion. Neither the author or the publisher warrants or assume any responsibility for the accuracy of the statements or information contained in this manual, and specifically disclaims the accuracy of any data, including stock prices and stock performance histories. No mention of a particular security or instrument herein constitutes a recommendation to buy or sell that or any security or instrument, nor does it mean that any particular security, instrument, portfolio of securities, transaction or investment strategy is suitable for any specific individual. Neither the author or the publisher, can assess, verify, or guarantee the accuracy, adequacy, or completeness of any information, the suitability or profitability of any particular investment or methodology, or the potential value of any investment or informational source. READERS BEAR THE SOLE RESPONSIBILITY FOR THEIR OWN INVESTMENT DECISIONS. NEITHER THE AUTHOR OR THE PUBLISHER IS RESPONSIBLE FOR ANY LOSSES DUE TO INVESTMENT DECISIONS MADE BASED ON INFORMATION PROVIDED HEREIN. At the time of writing, neither the author or the publisher has a position in any of the stocks mentioned in this manual. By proceeding with reading this course, you affirm that you have read and understand the above disclaimer.

Privacy Policy | Disclaimer | ben@theshortalert.com